The financial service startup brand "FINDA," a leading loan comparison platform, initiated a full-scale app launch in 2019. Leveraging innovative fintech technology and big data for loan management, FINDA rapidly gained market traction. However, despite its innovative services, awareness of loan comparison services remained low among the general public, excluding some involved in loan matters. With the ongoing expansion of loan comparison services by major traditional financial institutions, concerns arose about potential consumer trust decline in the relatively small-scale startup brand.

Therefore, FINDA, aligning with the increasing trend of contactless loans due to COVID-19, aimed to expand its services from comparison and management to debt consolidation. They desired to enhance their brand image, ensuring that "loan equals FINDA" resonates with the public on a broader scale.

Anticipating increased loan demand among the general public due to rising housing prices, base rate hikes, and the prolonged impact of COVID-19, FINDA saw a substantial market opportunity. However, the challenge lay in changing the deeply ingrained inertia towards loan services, centered around traditional financial institutions' loans and online banks (e.g., Kakao, Toss). Shifting the perspective and breaking the fixed mindset, particularly regarding loans as a product controlled passively, was crucial.

We observed that consumers harbored passive fixed notions about the financial product "loan." Unlike other financial products such as deposits, investments, and stocks, borrowing money through a "loan" was perceived as something beyond one's control, predetermined, and given. This led to a prevalent fixed mindset termed the "loan decision theory."

In response, our campaign aimed to change the frame of the passive perception that "a loan is something received" to the perspective that "a loan is something managed." The goal was to position "FINDA" as an essential app for loan users. Under this objective, instead of merely advocating for differentiation and convenience in loan services (the What perspective), we concentrated on emphasizing the innovative nature of FINDA's loan services (the Why perspective). After extensive deliberation, the core keyword we derived was "Restore Leadership in Loans." Through this keyword, we intended to instill an expectation in the target audience, prompting them to think, "Yes, why have loans been utilized the same way up until now? Things could change with FINDA."

The campaign's integrated solution aimed at addressing the vulnerability in brand credibility due to the brand's scale, especially when compared to competitors. We determined that increasing the emphasis on broadcast advertising, particularly on terrestrial broadcasting, CATV, and general programming, was necessary. To showcase the brand's innovation authentically, we chose "FINDA" co-CEOs Lee Hye-min and Park Hong-min as models, rather than celebrities.

In terms of video advertising, we created three pieces based on the criteria of comparison, management, and refinancing services. Each piece was structured to revolve around the foundational message of overturning fixed perceptions about loans, with the overarching theme of loan leadership. Following the main news on terrestrial channels, we increased the exposure time to 60 seconds and the central commercial (CM) proportion within key programs. This precise media operation aimed to enhance trust in the message.

Additionally, to heighten target interest in the "Loan Leadership" keyword early in the campaign, we utilized DMP to cross-analyze the preferences and movement patterns of target professionals, along with the usage situations of "FINDA" app users. We strategically increased the share of OOH execution in key app categories such as news platforms and automobile-related apps (new cars, used cars, navigation), especially in areas near offices. Notably, we focused on subway lines 2 and 3, along with bus advertisements at locations like Gangnam Station, COEX, and IFC, to increase exposure during commuting hours, synergizing with broadcast advertising for enhanced message awareness.

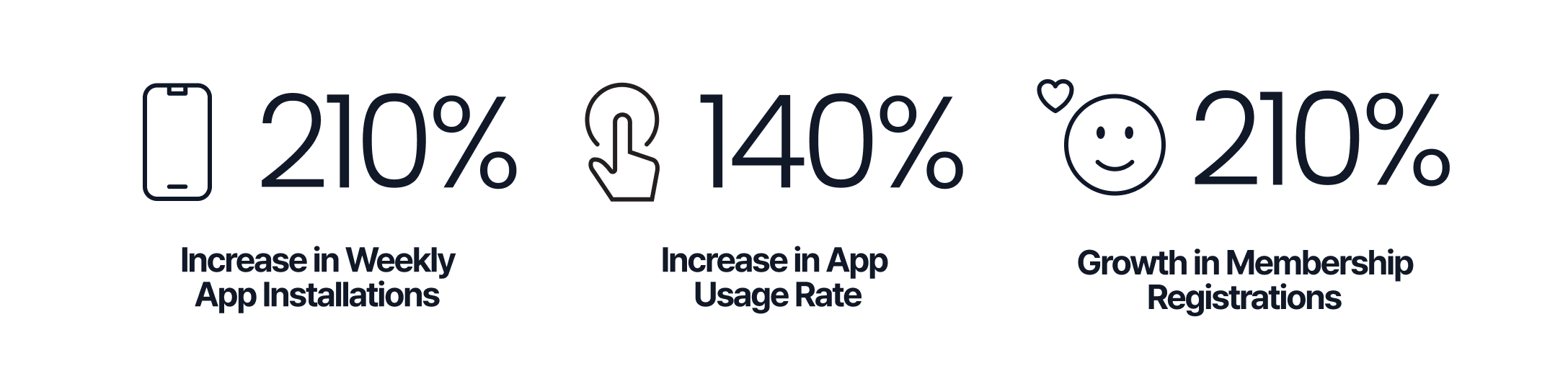

The campaign achieved outstanding results over a concentrated three-month period. The brand's first recall aspect increased by 8.3% compared to the previous period, maintaining the top position. Notably, it outperformed online banks like Kakao Bank and Toss. In addition to brand metrics, comparing pre-campaign and post-campaign periods, the app's weekly average installation increased by 210%, utilization by 140%, and membership registration by 150%. These quantitative achievements demonstrated visible success in actual customer acquisition.

Beyond quantitative success, the cumulative views of video ads exceeded 12 million, and posts related to "FINDA" ads on platforms like YouTube reflected sentiments such as, "I feel empathy for loan leadership. I should try using it right away," showing that consumers understood and resonated with the campaign's intent. As the campaign manager, I felt proud of achieving both quantitative and qualitative success.